Part A2: Details of TDS on sale of immovable property under section 194 IA (for sellers) If you have not submitted either of these forms, it shows ‘no transactions present’. It comprises information about the income when no TDS is applicable this is when you submit Form 15G or 15H. Part A1: Details of TDS for Form 15G or Form 15H The information in this section includes the name and Tax Deduction and Collection Account Number (TAN) of deductors, the total amount paid, total tax deducted, and total deposited tax against your PAN. The deductors file quarterly TDS returns, which can be seen in this form. Part A: Details of Tax Deducted at Source (TDS)

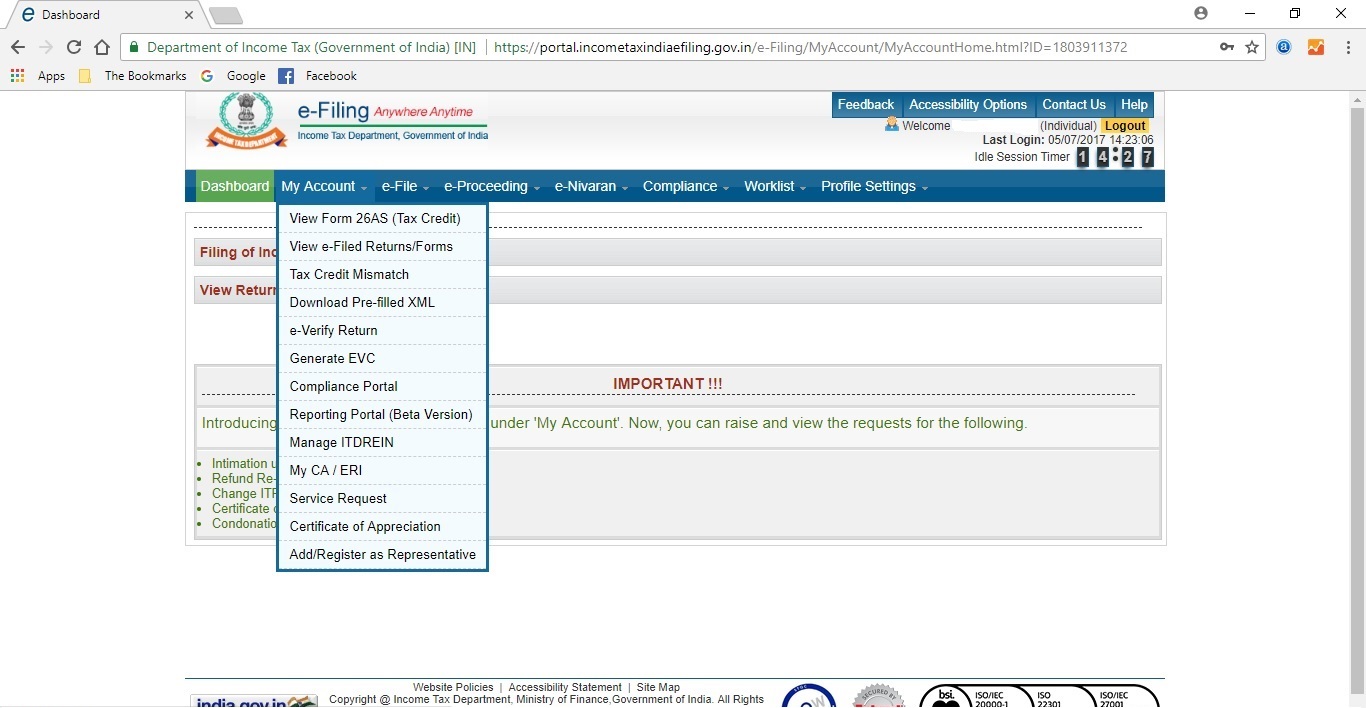

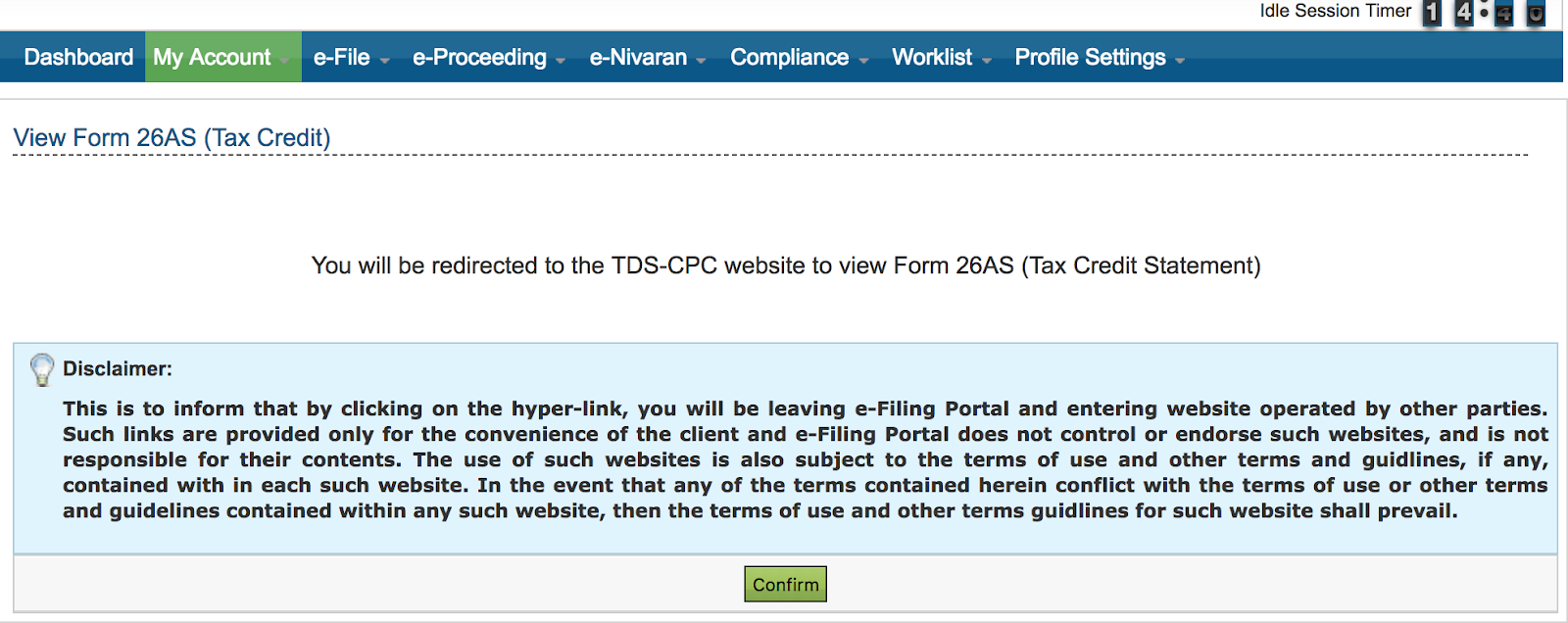

Enter your credentials and click ‘Continue’.Alternatively, you can use your login credentials on the income tax e-filing portal to download this form. The Form 26AS download can be done via the TRACES website. Step-by-step process to download Form 26AS The following banks allow you to view the form via net banking. on the TDS Reconciliation Analysis and Correction Enabling System (TRACES) portal.Īlternatively, the form can be viewed via Internet banking from Financial Year 2008–2009. Confirms that accurate tax is deducted by different entities and has been deposited in the government account.Works as a record of tax paid in your ITR.Confirms that the bank has accurately provided the details of tax deposited.

0 kommentar(er)

0 kommentar(er)